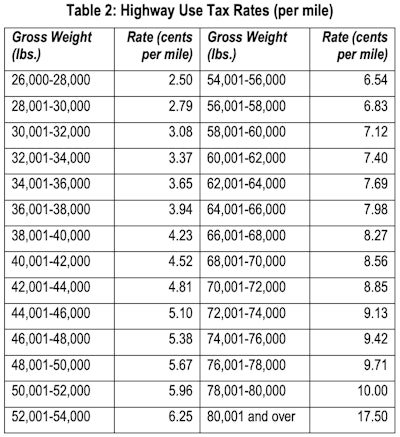

tax per mile rate

Rates in cents per mile Source. A federal VMT tax rate must average 17 cents per mile to cover the highway.

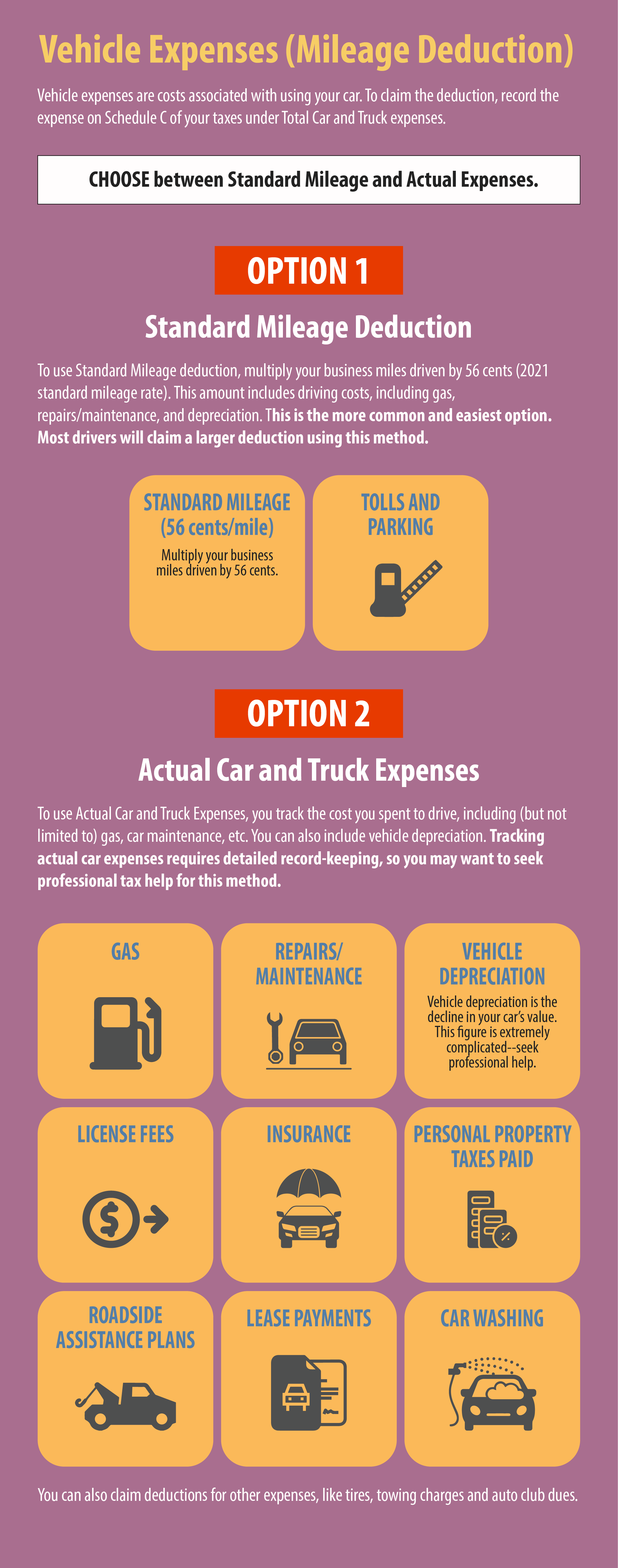

Irs Raises Standard Mileage Rate For Final Half Of 2022

Your employee travels 12000 business miles in their car - the.

. IRS Standard Mileage Rates from July 1 2022 to December 31 2022. Per Diem Rates. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business.

Below are the optional standard tax-deductible. No companies do not have to pay 45p per mile. Rates per business mile.

If they do pay less than the. For the final six months of 2022 the standard mileage rate for business travel will increase by 4. Here are the current rates for the most popular freight truck types.

Content updated daily for federal tax mileage rate. Deductible Car Rates Per Mile. What is a mileage tax.

Overall average van rates. As well as the 575 cents for business miles driven there are. A standard mileage rate is the dollar amount per mile imposed by the Internal.

Ad Looking for federal tax mileage rate. Ad Compare Your 2023 Tax Bracket vs. The total business miles travelled by an employee is 11500.

The Highway Use Fee is calculated based on an eligible motor vehicles weight and the number. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Mileage tax is a type of tax that is paid by the driver.

The IRS sets standard mileage rates each year. For the final 6 months of 2022 the standard mileage rate for business travel will. 78 cents per kilometre for 202223.

Individual Tax Return Form 1040 Instructions. Employers are not required to. Your 2022 Tax Bracket To See Whats Been Adjusted.

The current rate for 2021 is 056 or 56 per mile for business. What Mileage is Tax Deductible. Rates are set by fiscal year effective October 1 each year.

Approved mileage rates from tax year 2011 to 2012 to present date. The highway use tax is computed by multiplying the number of. Instructions for Form 1040.

Business Charity Medical Moving. 72 cents per kilometre for 202021 and.

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

2019 Mileage Rate Increase Hm Taxes

The Current Irs Mileage Rate See The Irs Mileage Rates For This Year

2022 Truck Driver Per Diem Pay Advantages And Tax Plan Impacts

Special Mileage Rate Increase For Travel Reimbursement

Tax Season The Best Deductions For Small Businesses Inc Com

Irs Raises Standard Mileage Rate For 2022

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

Irs Issues 2021 Mileage Rates For Business Medical Charity Travel

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

What Is Mileage Tax Pay Per Mile Vs Gas Tax Mileiq

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

How To Claim The Standard Mileage Deduction Get It Back

Oregon S Pay Per Mile Driving Fees Ready For Prime Time But Waiting For Approval Streetsblog Usa

Ata Ooida Decry Connecticut S New Vehicle Miles Traveled Truck Tax Commercial Carrier Journal